Opening New Accounts: Why So Many Different Types of Partnerships?

Suzie Jones, CFP

I opened my first new account 42 years ago in a downtown Houston bank. My training consisted of a solid 20 minutes with about 2 of those minutes dedicated to business accounts… sound familiar?

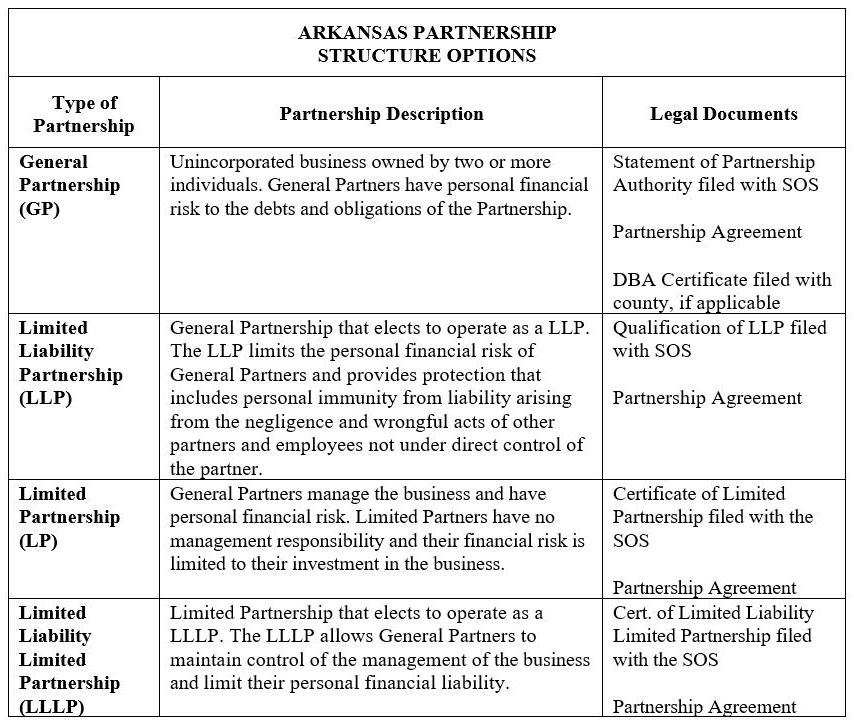

Back then, the most complex business account we opened was for a Corporation. Today that is not the case, as a matter of fact; we would almost prefer to open a corporate account any day as compared to all of the new complicated partnership accounts that have emerged in the last decade. We have gone from the plain vanilla General Partnership to the much more complex Limited Partnership, Limited Liability Partnership, and Limited Liability Limited Partnership!!! That last one is quite a tough twister! Why are there so many different types of partnerships?

Four Different Partnership Options

General Partnership (GP)

Limited Partnership (LP)

Limited Liability Partnership (LLP)

Limited Liability Limited Partnership (LLLP)

What's the Same?

All have General Partners.

What's Different?

Personal financial exposure and risk to the General Partners.

What kind of risk doe A general partner have?

As a business grows, so does the personal financial exposure to the General Partners. If something goes wrong in the business, not just the business assets but also their personal assets are at risk. Recently, there have been several new types of partnerships created with the goal of reducing the personal financial risk to General Partners.

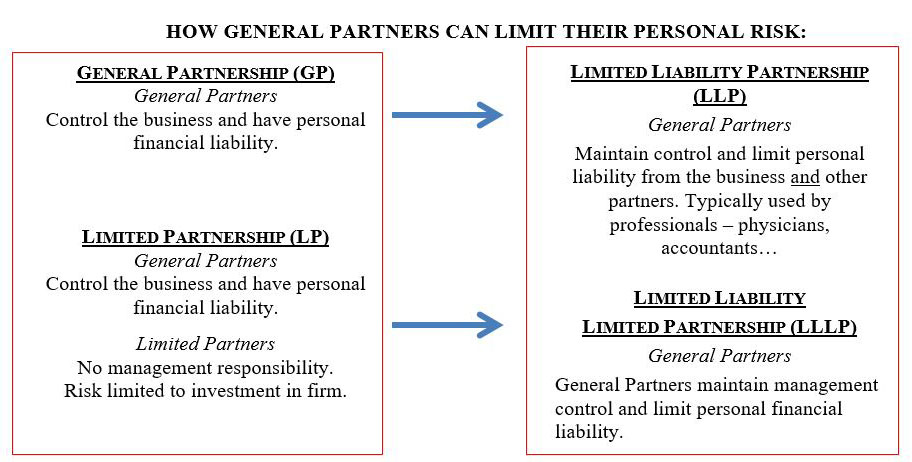

General Partnership >>> Limited Liability Partnership

With a General Partnership, the General Partners control the business and have personal financial liability and exposure for the debts and obligations of the partnership. In Arkansas, a General Partnership can register with the Secretary of State (SOS) to elect to operate as a Limited Liability Partnership (LLP). The LLP allows the General Partners to continue to take an active role in the management of the business while providing some liability protection from the actions of the other partners, the partnership and the partnership employees. This partnership structure is used often by professions where extreme cases of liability are customary as part of the business, such as law, architecture, or medicine.

Limited Partnership (LP) >>> LLLP

A Limited Partnership (LP) has two types of partners, General Partners and Limited Partners. The General Partners control the business and have personal financial liability and exposure. The Limited Partners have no management responsibility in the business and their financial risk is limited to their investment in the firm.

In Arkansas, a LP can register with the SOS to operate as a Limited Liability Limited Partnership (LLLP). The LLLP allows the General Partners to continue in the management of the business while providing personal liability protection.

Now It Makes Sense!

At the end of the day, the customer is opening a partnership account. It may be called a General Partnership, Limited Partnership, Limited Liability Partnership, or Limited Liability Limited Partnership, but just step back, take a deep breath, and realize you are simply opening a partnership account. The responsible party for each entity, no matter which partnership structure is used, will be a General Partner(s). The only difference to the bank will be the documentation required to open the account: